Your Guide to Setting Up a Free Zone Company in Saudi Arabia

Aug 4, 2025

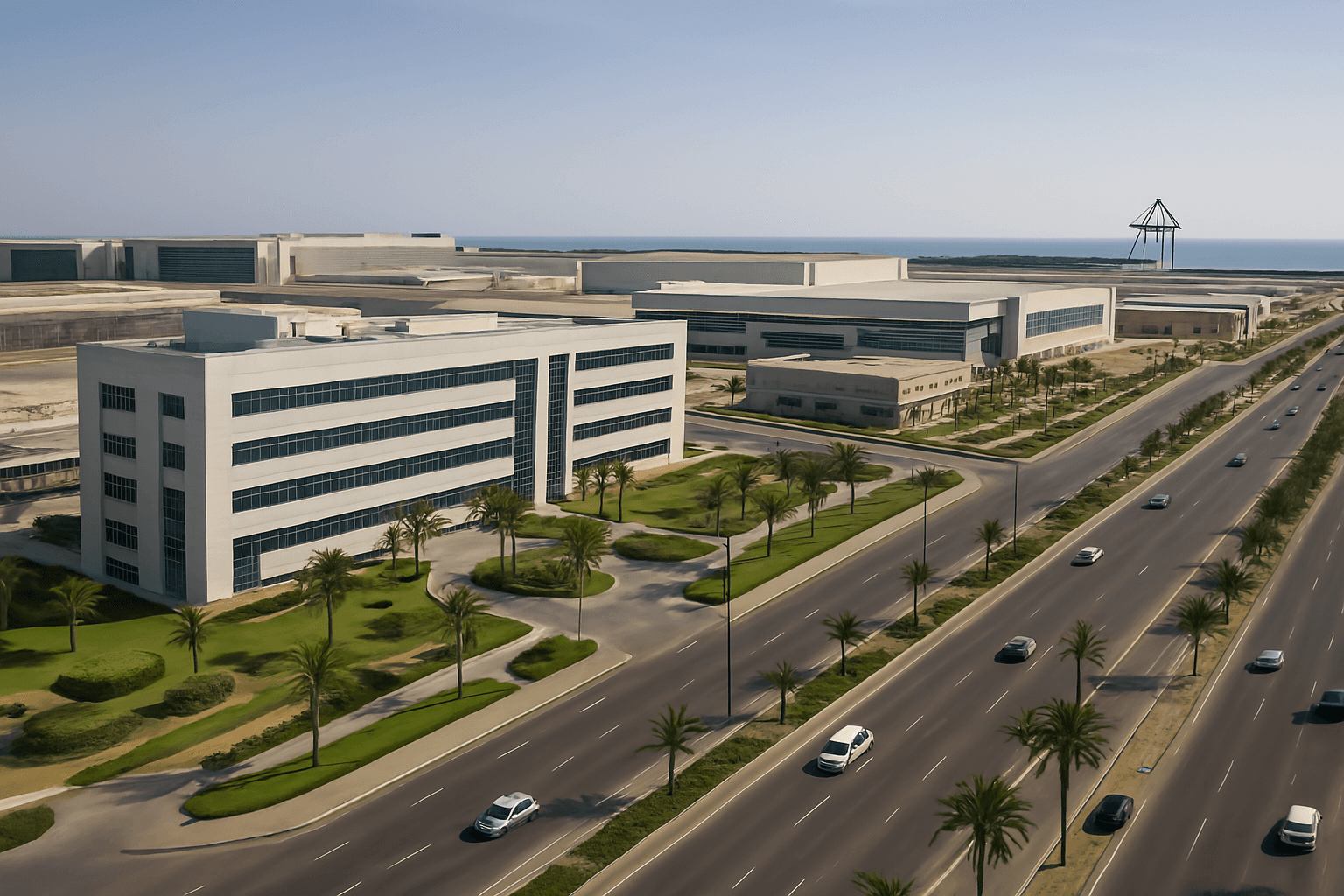

Launch your business in one of Saudi Arabia’s premier free zones—King Abdullah Economic City, SPARK, Jazan Economic City, and more

Saudi Arabia’s Vision 2030 has spurred the creation of specialized free zones to attract foreign direct investment and diversify the economy.

These zones offer world-class infrastructure, customs duty exemptions, and 100 percent capital repatriation, making them ideal for international entrepreneurs and established firms alike.

Launch your business today

Partner with us for a frictionless way to secure your future in the Middle East's future. Simply provide us with a few details and we will provide a free consultation.

What Is a Free Zone Company (FZCO)?

A Free Zone Company is a legal entity established within a designated economic zone that caters to specific industries—such as logistics, petrochemicals, technology, and manufacturing.

FZCOs in Saudi free zones permit up to 50 shareholders (individuals or corporations), all holding 100 percent foreign ownership with no local partner requirement.

Advantages of Forming an FZCO in Saudi Arabia

100 percent foreign ownership without a Saudi sponsor

Full repatriation of capital and profits

Exemption from customs duties on intra-zone trade and re-exports

Zero corporate tax under free-zone regulations; 5 percent VAT may apply only outside zone transactions

Simplified labor and visa processes within zone authorities

Access to integrated logistics, utilities, and ready-built facilities

Selecting the Right Free Zone

Choosing the ideal zone depends on your industry, logistics needs, and growth plans. Top options include:

King Abdullah Economic City (KAEC) for logistics, light manufacturing, and e-commerce

King Salman Energy Park (SPARK) for energy, petrochemicals, and heavy industries

Jazan Economic City for mining, agri-processing, and port services

Prince Abdulaziz Bin Mousaed Economic City (PABMEC) for food processing and automotive components

Cloud Computing Special Economic Zone (KACST-SEZ) for ICT, R&D, and cloud services

Evaluate each zone’s approved activities, fee structures, and proximity to ports or airports before deciding.

How to Register Your FZCO in Saudi Arabia

Define your business activities and select the matching free zone.

Submit an application to the free-zone authority with:

Passport copies of shareholders and directors

Memorandum and Articles of Association (AOA/MOA)

Business plan outlining objectives and financial projections

Obtain a Foreign Investment License from the Ministry of Investment (MISA).

Reserve your trade name and apply for Commercial Registration (CR) via the Ministry of Commerce portal.

Sign your office-lease agreement and pay registration and licensing fees.

Receive your CR certificate and free-zone business license.

Open a corporate bank account and deposit the required share capital.

Apply for residency visas, work permits, and family visas through the zone’s immigration services.

Cost Considerations

Fee Type | Cost Range (SAR) |

|---|---|

Free-Zone Registration | 10,000 – 25,000 |

License Fee (Annual) | 15,000 – 40,000 |

Office Lease | 12,000 (flexi-desk) – 60,000 |

Visa Permit | 3,500 – 8,000 per permit |

Additional expenses may include translation/legalization of documents, medical exams, and utilities deposits.

Regulatory Compliance and Taxation

Free Zone Companies benefit from 0 percent corporate tax and customs duty exemptions on qualifying transactions.

Annual license renewals, audited financial statements, and VAT filings (at 5 percent for out-of-zone supplies) may be required to maintain good standing.

How Launch Saudi Can Support You

With over 15 years of regional experience and 75,000+ company launches, Launch Saudi provides:

Free-Zone selection and legal-structure advisory

End-to-end licensing, MISA, and MoC applications

Bank-account facilitation and tech integrations

Visa and Iqama processing

PRO services, compliance monitoring, and renewals

Let us handle the complexities so you can focus on growing your Saudi business.

Launch your business today

Partner with us for a frictionless way to secure your future in the Middle East's future. Simply provide us with a few details and we will provide a free consultation.